Listen to this blog

In India’s parliament, the Union Budget for the financial year 2023-24 has already been presented. In this article, we’ll discuss the Indian Finance Minister’s stance on the country’s fiscal policy. While it has brought about significant improvements, just a handful of those modifications have been implemented so far.

What is fiscal policy? Why is it important?

A nation’s fiscal policy describes the means through which the government may collect and spend money. Taxation, public spending, and public borrowing are the mechanisms used to ensure that economic policy objectives are achieved. In other terms, the growth of the economy depends on the government’s income and expenditures for its continued survival. Capital expenditure refers to the funds spent by the government of a country to enhance, sustain, and expand the economy. The difference between the government’s total revenue and total expenditures is known as the fiscal deficit.

The extended capital investment in the budget was a highlight, as it shows a 33% increase, a jump of 10 lakh crore, while registering a significant reduction in bank non-performing assets. This was observed with the increase in NPAs on the lower and improving banks. Compared to the present fiscal deficit rate of 6.4% of GDP for the fiscal year 2022-23, it is predicted that the fiscal deficit for the fiscal year 2023-24 will be 5.9% of GDP.

Check out: Emerging trends in the BFSI industry

Tax deductions as per the new tax regime

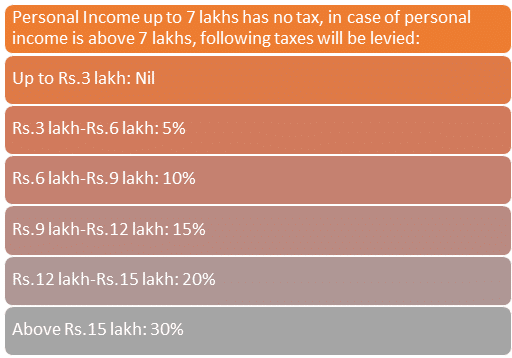

The government obtains revenue from a variety of sources, including taxes and borrowings. The Individual Income Tax is anticipated to experience the most dramatic change. The following are the amended income tax brackets under the new tax regime:

Governments get their funds through income tax, capital gains, and borrowing. 15% of the government’s total revenue comes from personal income tax, making it one of the main revenue streams. The government has continued to provide refunds on tax brackets. It is expected to provide an effective solution for controlling inflation and any kind of economic recession. Citizens will benefit from a decrease in income tax and an increase in capital expenditure as those with lower incomes will have more purchasing power and an improved quality of life.

Also read: What does the career path of financial advisor look like?

Pursue a career in the in-demand finance sector with an online degree from MUJ

Finance professionals can better comprehend the finance policies and budget of the nation. Finance is one of the most crucial and in-demand sectors in the country and choosing a career in finance can be lucrative for anyone. While B.Com will be the most suited UG degree for finance aspirants, even students from other graduation backgrounds also can pursue a career in finance by taking up relevant PG degrees. These days, most students and working professionals are opting for online PG courses as they are treated at par with the on-campus degrees and are much more flexible and affordable. Manipal University Jaipur offers online PG degrees like M.Com, MBA in Finance, MBA in BFSI, and MBA in IT & Fintech, which are a great way for candidates to equip themselves with the knowledge and skills to become a successful finance professional.

Become future-ready with our online MBA program

View All Courses