Listen to this blog

India has 26 FinTech unicorn and stands at the fourth positions in terms of number of FinTech unicorns. The number of registered FinTech companies are 10,200 in 2024, which is a quick growth from 2,100 in 2021.

As a result, the sector offers several Fintech job opportunities to develop, innovate, and flourish. The global finance business is redefined by artificial intelligence, machine learning, and blockchain technologies, and an MBA degree equips students with these emerging technologies.

As more renowned banks, venture capitalists, and asset management companies are now welcoming digital disruption; there is a need for skilled individuals in the FinTech sector. Therefore, an MBA in IT & FinTech can provide a variety of employment opportunities for individuals.

You can also read Important concepts to learn during an MBA in IT and Fintech.

Jobs you can get after an MBA in IT and FinTech

Here are a few of the most in-demand roles you can explore after an MBA in IT & FinTech.

- Financial Analyst

Financial analysts organize and assess a company’s finances to help the organization make wise business decisions. They analyze past financial data, predict future outcomes, and propose procedural and policy improvements.

- Credit Analyst

Credit analysts assess a borrower’s prior financial and credit records to ascertain their current financial situation and their capacity to pay back credit that a lender has extended to them.

- Venture Capital Analyst

The venture capital analyst’s responsibility is to determine which companies are worthwhile investments. They establish connections with venture capital firms, collaborate with them to determine the market’s need for potential startups, and then fund those startups so they can grow.

- Chief Financial Officer

The chief financial officer’s responsibilities include analyzing the company’s financial merits and flaws and suggesting corrective measures. They are in charge of overseeing the accounting and finance departments and making sure that the company’s financial reports are precise and finished on time.

- Financial Risk Manager

Financial risk managers are experts at understanding and managing financial risks. Their duties may also include analyzing risks, recognizing menaces to assets, and providing solutions to risks. They are also responsible for creating plans to offset the effects of changing market conditions on enterprises and their financial affairs.

- Blockchain Developer

Blockchain developers create systems to collect and preserve blockchain data in a manner that hinders alterations or hacking, enabling secure digital transactions. They create application functionality and interfaces, safeguard blockchain technologies, and client and server-side apps.

- Data Scientists

Data Scientists collect data and analyze it to extract information that can be used to forecast financial information. They assess and analyze data from various sources to find solutions to financial challenges.

- Cybersecurity Experts

Cybersecurity Experts carry out investigations, create a plan of action, and build security solutions using scenario-based testing. They use smart encryption to protect data and systems and find and fix flaws to thwart future assaults.

| Job roles | Average salary |

|---|---|

| Financial Analyst | ₹ 4.0 LPA |

| Credit Analyst | ₹ 5.2 LPA |

| Financial Risk Manager | ₹ 9.2 LPA |

| Blockchain Developer | ₹ 6.5 LPA |

| Data Scientist | ₹ 10.2 LPA |

| Cybersecurity Expert | ₹ 14.2 LPA |

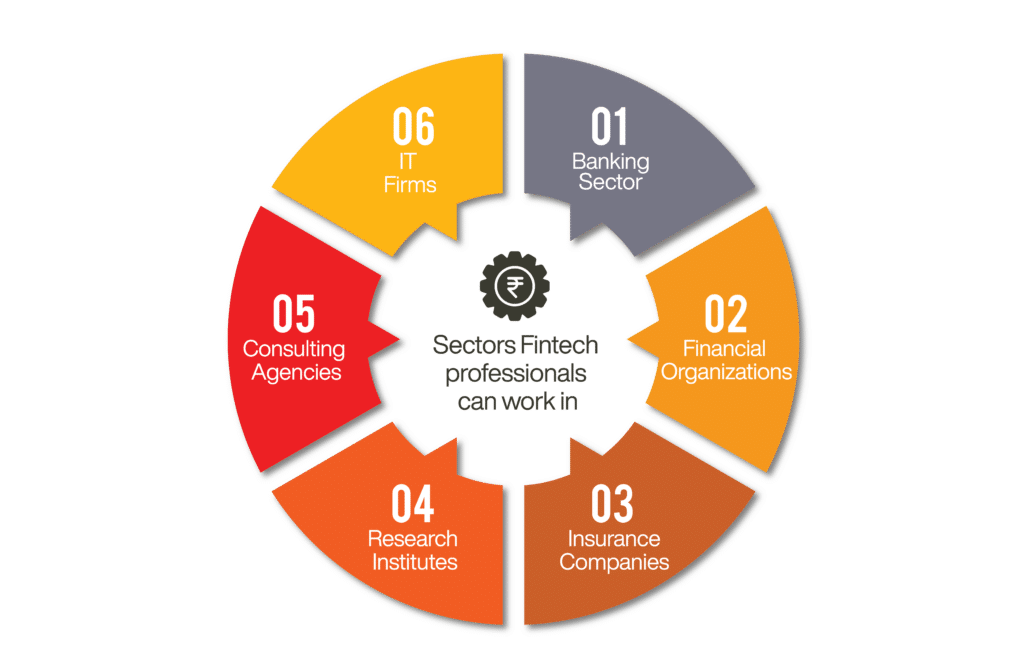

Sectors in which FinTech professionals can get jobs

FinTech is a competitive industry and is growing rapidly with new innovations and technologies. There is no better time than now to enter this technologically advanced industry and begin your career in various sectors after MBA in IT & FinTech. FinTech professionals can work in various sectors, such as:

- Banks

- Financial institutes

- Insurance companies

- Marketing agencies

- Research institutes

- Consulting agencies

- IT firms

How does an MBA in IT and FinTech pave the way for a lucrative career?

Manipal University Jaipur offers an online MBA in IT & FinTech course through Online Manipal, to provide in-depth exposure to pivotal FinTech domain components. This program is designed for experts who desire to hold managerial roles in the FinTech sector. Candidates who have enrolled in this program get access to live and record classes from expert faculty, attend career-oriented webinars from industry experts, and get placement assistance after completion of the program.

To know more about the syllabus of the program, read MBA IT & FinTech course syllabus.

Eligibility Criteria

- Candidates must have a 10 + 2 + 3 year bachelor’s degree from a recognized university/institution or an equivalent qualification as recognized by the Association of Indian Universities

- Candidates must have a minimum of 50% marks in aggregate in graduation (45% for reserved categories)

Conclusion

The current market offers thriving chances for an MBA professional skilled in digital finance and banking studies. Pursue an online MBA in IT & Fintech from Manipal University Jaipur if you want to advance your career and are intrigued by the field of Fintech. This course gives individuals a better understanding of industrial policies and standards in the FinTech sector, making them more ready for potential employers and the marketplace.

Become future-ready with our online MBA program

View All Courses